[ad_1]

US President Donald Trump on Wednesday paused sweeping tariffs on most nations—but pointedly excluded China, jacking up levies on Beijing to a punishing 125%. China, in turn, hit back with retaliatory tariffs of 84% and vowed to “fight to the end.”

China on Thursday called on the United States to meet it “halfway” in the escalating trade war. “The door to dialogue is open, but it must be based on mutual respect and conducted in an equal manner,” said commerce ministry spokeswoman He Yongqian.

“The US tariffs seriously damage the rules-based multilateral trading system, and seriously impact the stability of the global economic order,” said foreign ministry spokesman Lin Jian. “This is a blatant act that goes against the will of the world and goes against the whole world.” China will not sit back and let the legitimate rights and interests of the Chinese people be deprived, Lin added.

Why it matters

The US-China trade war has entered uncharted territory, threatening to fracture the world’s most important bilateral economic relationship and disrupt the global trading system.

This isn’t just another tariff spat—it’s a geopolitical showdown with ripple effects far beyond Washington and Beijing. The two countries represent nearly 40% of global GDP and account for over a quarter of global trade. A rupture between them isn’t just bilateral pain—it’s systemic shock.

Here’s what’s at stake

- Global supply chains: China is the world’s manufacturing hub, and US tariffs on its exports are already forcing multinationals to rethink sourcing. That means years of volatility, higher costs, and slower transitions for industries from tech and autos to apparel and pharmaceuticals.

- US inflation and recession risk: Tariffs function like a tax on imported goods. As prices for consumer electronics, home goods, and industrial parts rise, US households and businesses are already feeling the pinch. Economists warn that prolonged tariff hikes could tip the economy into recession—especially as the Fed struggles to contain inflation without derailing growth.

- Chinese economic fragility: China is still recovering from its property sector collapse, high youth unemployment, and years of weak consumer demand. A drawn-out trade war could choke off one of its few bright spots—exports—at a time when confidence in its recovery is already shaky.

- Investor uncertainty: The unpredictability of Trump’s tariff moves—escalating one day, pausing the next—has rattled markets. Companies, particularly in tech and finance, face a high-risk environment with no clear policy roadmap.

- Geopolitical decoupling: Beyond the economy, the tariff war is accelerating a broader strategic decoupling between the US and China. That includes technology, defense, academia, and even diplomacy—threatening decades of interdependence that have defined the post-Cold War era.

The big picture: A long game, not a quick resolution

1. Xi’s strategy: Strength at all costs

Xi Jinping is not seeking a face-saving way out of Trump’s tariff spiral. He’s preparing for long-term confrontation. Xi’s messaging is clear: China will not buckle under pressure. State media has leaned hard into nationalist rhetoric, framing the trade war as a patriotic struggle. The People’s Daily declared China had “rich experience” in managing economic conflict with the US and “ample plans” to support domestic industries.

Xi has been very clear for a very long time that he expects China will enter a period of protracted struggle with the United States and its allies, that China needed to prepare for that, and they have quite extensively,” said Jacob Gunter, lead economy analyst at Berlin-based think tank MERICS. Xi Jinping has accepted that the gauntlet is thrown down, and they are ready to put up a fight.

An article in CNN

But this isn’t just about appearances. For Xi, giving in to Trump’s demands would weaken his image at home and abroad. As China’s most powerful leader since Mao, he can’t afford to be seen capitulating to a US president who boasts of “winning” every escalation. “China wants to make a deal, they just don’t know how quite to go about it,” Trump said. Beijing’s response? Silence and defiance.

2. Built for the long haul: Strategic endurance

Beijing has spent years preparing for this moment. After enduring Trump’s first trade war, Chinese officials launched a quiet but sweeping effort to reduce their economy’s exposure to the US.

The results are now surfacing:

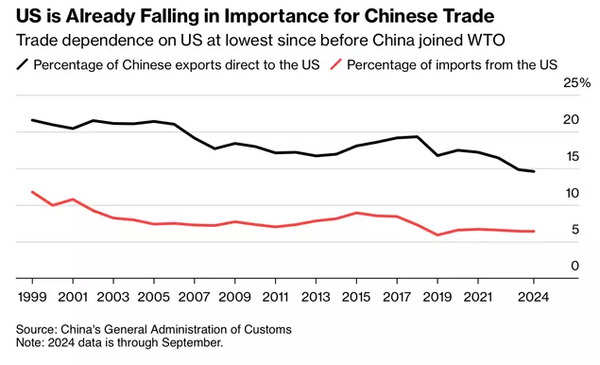

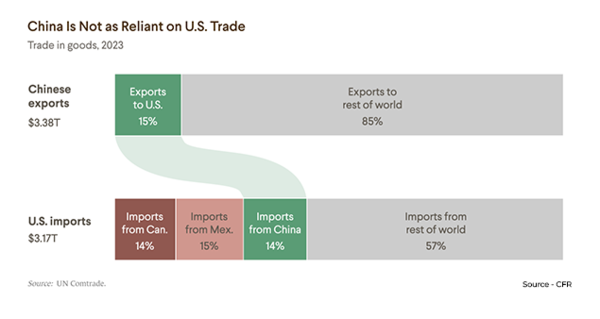

- US-bound exports have dropped from 20% of China’s total in 2018 to under 15% today.

- Manufacturers moved operations to third countries like Vietnam and Cambodia to sidestep tariffs.

- China’s rare earth and advanced tech sectors have been strategically fortified.

- Domestic innovation in AI, robotics, and semiconductors—especially via firms like Huawei and DeepSeek—has surged.

- “The Chinese government has been preparing for this day for six years,” Victor Shih, of UC San Diego, told CNN.

- China’s new posture signals that it’s not just surviving the trade war—it’s trying to use it to pivot away from economic dependence on the US.

3. Xi is ‘president-for-life’; Trump is not

Thousands marched in Washington and cities nationwide over the weekend, voicing opposition to President Trump. He’s also drawing heat from Wall Street, where investors blame his tariffs for rattling global markets and triggering economic uncertainty.

In contrast, Chinese President Xi Jinping faces no such public backlash. With tight control over media and dissent, he can roll out monetary and fiscal support as needed to soften the social fallout.

“Ultimately, it becomes a game of which country can actually manage its own population more effectively to manage the subsequent economic consequences from this trade war. Trump has to face, or at least Republican politicians have to face a lot of electoral pressure, and the American media are still pretty much free. So I think Trump’s ability to fight politically with China is not that great,” Zhiwu Chen, professor of finance at HKU Business School, told Reuters.

4. Economic costs: A two-way street

Both sides are feeling the pain. For China, the latest wave of tariffs could wipe out entire industries. Victor Shih, director at UCSD’s 21st Century China Center, warns of “millions of people becoming unemployed” and “a wave of bankruptcy” across Chinese exporters, according to a CNN report. Yet he also notes: “China can sustain that much more so than American politicians can.”

In the US, JP Morgan analysts estimate that tariffs on China could cost American consumers and businesses up to $860 billion. Many Chinese goods—especially electronics, appliances, and industrial inputs—are hard to replace quickly. That means higher prices, supply chain disruptions, and delayed reshoring.

What’s more, some of America’s biggest multinationals—like Tesla and Apple—have massive exposure in China. Chinese officials know this and have suggested they might target US firms, restrict services, or even ban entertainment content as part of the response.

5. Diplomatic recalibration: Beijing’s global hedge

Even as Trump isolates China, Xi is deepening ties with Europe and Southeast Asia, offering incentives like lowered tariffs and increased export subsidies to sidestep US markets—and woo America’s frustrated allies.

Trump thrives on disorder, keeping adversaries off-balance and sharpening his leverage. China, by contrast, is trapped in the art of the delay, waiting for clarity that never comes. The longer Xi stalls, the greater the peril, as Trump fills the vacuum with new tariffs and sidelines Beijing in a game that keeps accelerating.

An article in Foreign Policy

Zoom in: ‘Xi will not be forced into a call’

One of the most dangerous dynamics is the absence of credible negotiators. Trump has centralized trade decisions around himself, leaving cabinet officials and envoys unable to act with authority. China, watching the chaos, no longer knows who to talk to. Meanwhile, Xi has gutted China’s diplomatic flexibility—only he can decide to soften or escalate, and he has little incentive to back down, a Foreign Policy article said.

“Xi will not be forced into a call,” Sun Yun, director of the China programme at the Washington-based think tank Stimson Centre, told AP. Craig Singleton, the senior China fellow at another Washington-based think tank, told AP that a phone call from Beijing is “unlikely in this climate.”

“Each side believes time is on its side, which raises the risk that neither moves to de-escalate until real damage is done,” he said. “This is no longer about tariffs alone. It’s a test of wills.”

Bottom line

Trump and Xi are now trapped—each by their own strategy. Trump has framed the trade war as a crusade for economic justice and can’t afford to appear soft on China. Xi has stoked nationalist pride and positioned himself as the leader who will never bow to Western pressure. The result is a deadlock with no clear exit, no trusted interlocutors, and no incentive—political or economic—to fold.

(With inputs from agencies)

[ad_2]

Source link

Be the first to leave a comment