[ad_1]

Warren Buffett’s life is a masterclass in how to invest. There has been no other investor like him, and it is doubtful whether there will ever be any investor who can match up to the veteran’s track record.

On Saturday, the Berkshire Hathaway CEO announced that he would retire by the end of 2025, handing over reins to Greg Abel. Buffett’s announcement took everyone by surprise.

Buffett’s remarkable investment achievements stand unmatched in financial history. His exceptional performance as an investor remains unparalleled, setting a benchmark that appears insurmountable for future generations.

Whilst many discuss how life experiences influence investment decisions, Buffett has demonstrated a unique ability to integrate investment principles into everyday existence.

Buffett, among the world’s richest individuals and most successful investors, assumed leadership of Berkshire Hathaway in 1965 whilst it operated as a textile manufacturing firm. He transformed the organisation into a diversified enterprise by acquiring undervalued companies and stocks.

His exceptional investment acumen elevated him to legendary status on Wall Street. This prowess led to his moniker “Oracle of Omaha”, acknowledging his birthplace and chosen hometown in Nebraska where he continues to reside and conduct business.

Also Read | Warren Buffett to hand over reins to Greg Abel: Top 10 things to know about ‘Oracle of Omaha’s’ successor at Berkshire Hathaway

5,502,284% returns!

Buffett has always avoided complex financial instruments and aggressive corporate takeover methods, preferring instead to focus on sustained, long-term investment strategies.

His enduring achievement remains Berkshire Hathaway, the Nebraska-headquartered conglomerate that owns various businesses, including Duracell batteries, Geico insurance, paint manufacturers and diamond companies.

The organisation maintains strategically chosen shareholdings in prominent American corporations, including Coca-Cola and Chevron.

As reported by Forbes magazine’s real-time wealth tracker on Saturday, Warren Buffett’s wealth stands at $168.2 billion, positioning him as the world’s fifth wealthiest individual.

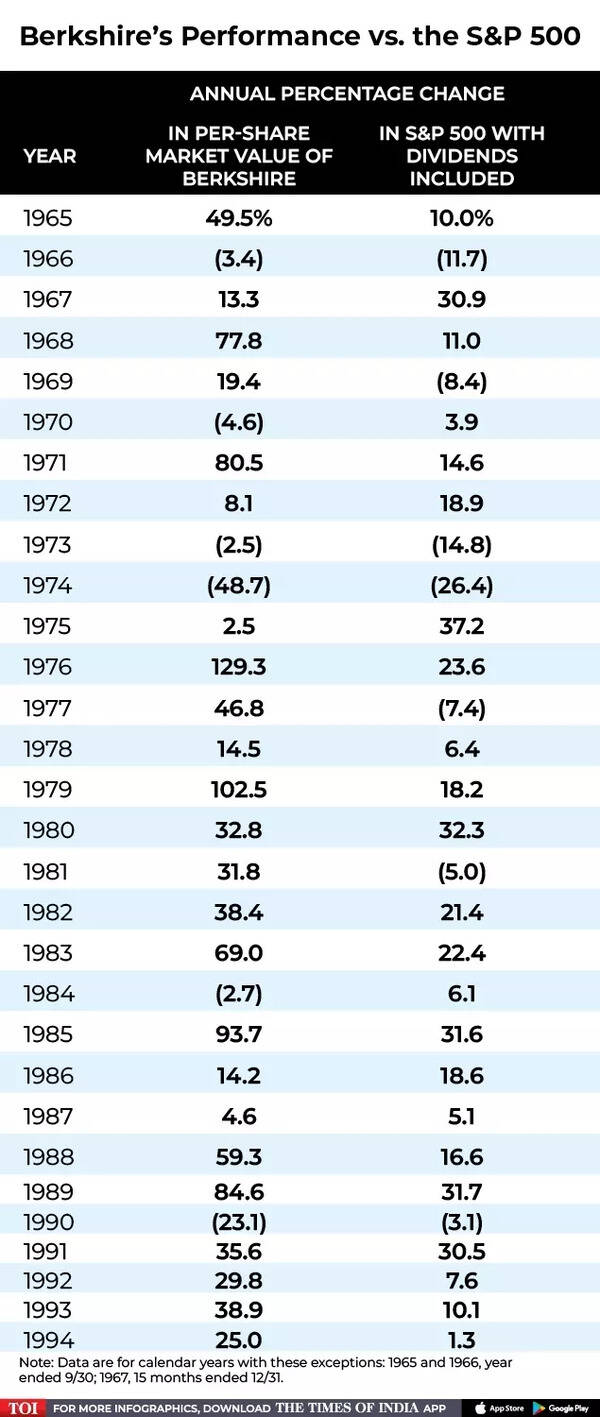

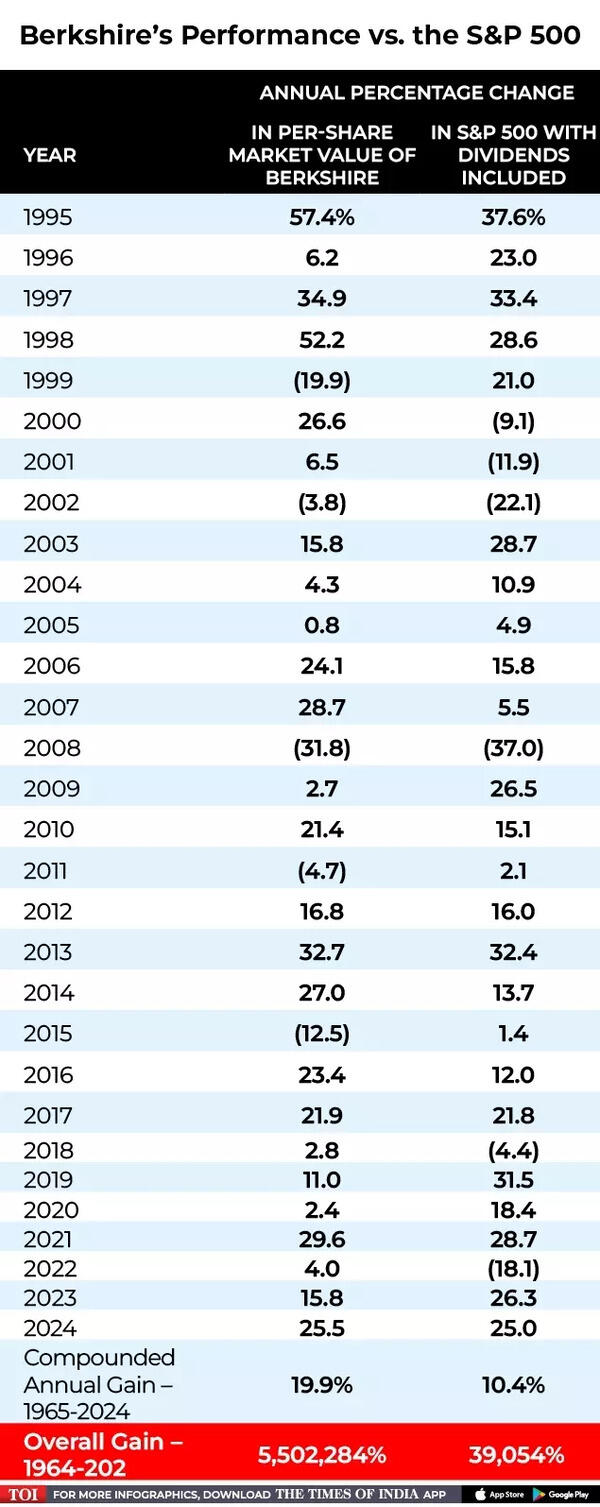

From 1964 to 2024, if one were to compare the performance of Berkshire with S&P 500 – the former has gained 5,502,284%! As mind-boggling as the number appears (it’s 5.5 million percent!) – it’s true! S&P 500 on the other hand has delivered 39,054%. This is as per data shared in Warren Buffett’s annual 2024 letter to shareholders in February this year.

Berkshire vs S&P 500

Berkshire vs S&P 500 returns

So basically, Berkshire Hathaway has outperformed the S&P 500 by over 140 times!

During the 1950s, Buffett worked on Wall Street and established the Buffett Partnership, which later combined with Berkshire Hathaway in 1965.

As an enthusiastic reader of financial publications and other materials, Buffett focused on investments he considered undervalued, maintaining his positions until they became profitable.

He developed Berkshire into a diverse conglomerate recognised for investments in fundamental sectors including energy, banking, air travel and food. The portfolio includes stakes in Citigroup, Kroger, Apple and American Express.

He managed Berkshire alongside his long-term vice chairman Charlie Munger, who was six years older than him.

Also Read | Warren Buffet, world’s 5th richest person, has $169 billion net worth: Here’s a look at his investments

Warren Buffett’s Best Investments

Apple: Did you know that Buffett has consistently maintained his reluctance to invest in technology firms, citing his limited understanding of their valuation and long-term viability?

However, he made an exception in 2016 when he began acquiring Apple shares. His rationale for investing more than $31 billion was based on his perception of Apple as a consumer goods company that commanded exceptional customer loyalty. The investment proved highly profitable, with its value escalating to over $174 billion before Buffett initiated the sale of Berkshire Hathaway’s holdings.

National Indemnity and National Fire & Marine: Acquired in 1967, these firms marked Buffett’s initial ventures into insurance. The insurance float – premiums received before claims settlement – served as investment capital for numerous Berkshire ventures, significantly contributing to the organisation’s expansion. The insurance segment has since expanded to encompass Geico, General Reinsurance and additional insurers. By the first quarter’s end, the float reached $173 billion.

Strategic investments in American Express, Coca-Cola Co. and Bank of America were made during periods when these companies faced challenges due to controversies or market situations. These shareholdings have appreciated by more than $100 billion above their purchase price, excluding substantial dividend earnings accumulated over time.

Warren Buffett’s humble beginnings

- Born on August 30, 1930, in Omaha as the second of three children, Buffett developed an early interest in business after reading “One Thousand Ways to Make $1,000” during his boyhood.

- Buffett saw a challenging childhood. He went through a period of shoplifting and had to deal with his mother Leila’s abusive behaviour, who would call his sister Doris “stupid.”

- Although he considered discontinuing his education, his father, who worked as a businessman and served as a congressman, prevented him from doing so.

- He initially studied at the University of Pennsylvania before moving to the University of Nebraska, where he completed his business degree.

- Subsequently, he earned a Master’s degree in economics from Columbia University in New York in 1951.

‘Oracle of Omaha’s’ simple lifestyle & philanthropy

Despite his immense wealth, Buffett maintains a distinctly modest lifestyle, avoiding the extravagant pursuits typical of ultra-wealthy individuals, such as collecting expensive artwork or owning multiple luxurious properties globally.

His residence remains the same modest house in a peaceful Omaha suburb, purchased in 1958 for $31,500.

His daily dietary preferences are notably simple, consisting of McDonald’s Chicken McNuggets thrice weekly, potato chips for snacking, ice cream as dessert, and approximately five cans of Coca-Cola daily.

For leisure, he enjoys playing bridge and strumming the ukulele.

In 2006, Buffett admitted to owning a private aircraft, stating it simplified his lifestyle. That same year, he pledged to give away 99 percent of his wealth to charitable causes.

Alongside his bridge companion Bill Gates, Buffett successfully encouraged other billionaires to commit to donating at least half their fortunes.

These philanthropic initiatives have earned Buffett widespread admiration in American society, attracting numerous small investors to Berkshire’s annual spring gathering in Omaha, an event that’s come to be known as a “Woodstock for capitalists.”

As the world’s most famous and wise investor bows out of the role of Berkshire Hathaway, investors around the world would continue to make the most of his timeless investment mantras.

[ad_2]

Source link

Be the first to leave a comment